Prior to 2020, the fitted kitchen market was in strong shape.

Only two years ago, in 2018, the market had grown to £4.2 billion in value and was closer to £4.4 billion in 2019.

However, the unpredicted impact of Covid-19 led to a grinding three-month halt in non-essential home renovations during the first half of 2020. Beyond that, though, it changed customer confidence and resulted in both positive and negative buying patterns.

With the benefit of hindsight, how did that impact the kitchen renovations industry, and what was its footing heading into 2021?

There was plenty to learn from 2020 and now that we’ve had time to stand back and analyse it, what’s clear is that there are a number of key opportunities that the sector needs to take advantage of if it is to continue growing in the future.

A year of trials, tribulations, and major success

With Government restrictions between March to June last year forcing many of us to remain indoors, the UK saw an influx in enquiries for home improvements – including kitchens – post the original lockdown.

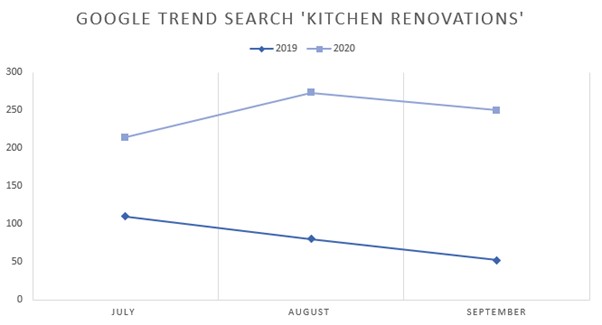

According to Google Trends research by More Kitchens, there was a huge spike between the beginning of July and the end of September 2020 in the public searching for information on the term ‘kitchen renovations’.

In fact, results showed search volumes were an average of 205% higher when compared to the same period in 2019.

As we know, the UK didn’t face just one lockdown, but two during 2020. A tier system was also deployed across the nation and this, naturally, resulted in both positive and negative effects on the kitchen renovations industry.

While the sector saw a significant boost in enquires and sales, like a monopoly effect it raised some glaring problems.

1) Boost in renovations

During the time when non-essential work was put on hold and holidays were cancelled, much of that time and investment, instead, went into home renovations, including kitchen refurbishments.

A recent report by Trend Monitor found that of 1,000 participants asked, only 7% did not plan to go ahead with bathroom and kitchen works during 2020.

Rather than saving the money they were no longer spending on planned vacations, that money was switched and put towards completing home DIY projects.

In line with that, the housing market enjoyed a mini-boom during the second half of 2020 – partly because of the impact of Covid-19 also because of the renovations that were being completed, providing a much-needed value boost.

Rob Hands, an installations surveyor for More Kitchens, said: “What was clear in 2020 was that people were saving more money and staying indoors. Instead, consumers wanted to spend their time and money on improving their homes, particularly in the kitchen where it can help to add to their overall house value.”

2) Supply limitations

A direct follow on from the previous point and while Covid-19 may have boosted the kitchen renovations market, it had a similar impact at the opposite end of the spectrum with regards to meeting supply and demand.

A research article by KBB in November last year found that several kitchen and bathroom retailers faced many supply issues last year, with poor communication, delayed orders, and extra delivery charges being cited as three of the top reasons behind them.

What this inevitably led to were installation timeframes taking far longer than they originally did in a pre-Covid-19 world.

Rob Hands added: “We found with some of our kitchen appliance suppliers that it was becoming difficult for them to supply for the influx in demand, which led to a delay in supply times. The required Covid-19 safety restrictions, such as social distancing, meant some distributors and suppliers were also unable to operate at full capacity.

“You’ve also got to take into account those who have unfortunately not been able to work for health reasons and or having to self-isolate, which added extra pressure on the shoulders of suppliers.”

3) Skills shortage

This isn’t so much a new issue, but one that continues to increase pressure in the industry with every passing year.

According to research, the shortage is due to the UK construction workforce being an aging one, with over 20% of tradespeople being over fifty and 15% being in their sixties.

The trouble is, as these plasterers, painters, and plumbers retire, the same percentage of young people are not entering these professions – a pressure point that has been heightened given that delivering hands-on training to new employees and apprentices was much more difficult to complete during 2020

Damian Walters, Chief executive of the British Institute of Kitchen, Bedroom and Bathroom Institute states: “For installation, the challenge over the last decade has been the skills shortage – a shortfall of professional tradespeople to meet consumer demand.”

4) Job postponements

While this does go against our original point of a mini-industry boom with many turning to home projects, that itself has caused problems for businesses later down the road in the form of job postponements.

While kitchen renovation companies saw a strong rebound following the end of the first lockdown, the second half of the year also saw an increase in consumer uncertainty – a knock-on effect caused largely by financial concerns and job security.

According to YouGov research in October 2020 consumer confidence fell to a six-month low as Covid restrictions increased due to several reasons, including household finances and property value.

The four key opportunities for 2021

While the Covid-19 pandemic has seen some setbacks in the kitchen and home renovations industry as a whole, there is a lot that it can learn and take away from 2020 as it aims to get firmly back on track over the next 12 months.

1) Industry Growth

Although research suggested that ongoing Covid restrictions have led to a drop in customer confidence, consumers as a whole are still planning to renovate their homes.

The introduction of a new Covid-19 vaccine is beginning to improve customer confidence, a result of hopefully the end being in sight.

Indeed, further research by YouGov suggests that ‘consumer confidence has improved slightly as vaccine nears’ with ‘households feeling more upbeat about their finances and house prices.’

2) Kitchen Design Trends

Clean, minimal, and modern designs were well and truly embraced during 2020, and far from a fleeting fad with over 70% of our kitchen installs demonstrating this particular design, they are set to remain popular over the coming year.

Julie Gokce, senior design for More Kitchens, said: “Trending colours are set to be bottle green and dusky pink, alongside the usual greys and warmer beige tones. We’re also seeing more interest turn to functional fixtures, including for self-clean ovens and instant hot water taps, and that’s something I expect will continue during 2021.”

3) Investment in skills

To help combat the installation skills shortage, and catch up with demand, companies within the home improvements sector are continuing to offer, and or setting up new, initiatives to offer further training, qualifications, and apprenticeships to help build skills for new and existing employees.

This includes the British Institute of Kitchen, Bedroom & Bathroom Installation (BIKBBI) which has set up an initiative to tackle the national shortage of professional installers, including the creation of apprenticeships, professional development, and re-training.

4) Delivering a quality online presence

With the lockdown forcing many of us to stay at home, kitchen retailers are working to adapt to and improve customer experience online.

With the aim to offer a personalised experience for customers without showroom and home visits, online changes include the implementation of virtual showrooms, informative and updated website content, and the use of social media channels to engage directly with customers.

Trevor Scott, the Rugby Fitted Kitchens boss, referenced in a recent article his business had obtained success by ‘adding content to make it easier for consumers to navigate through the whole design-to-order process online rather than in-person.’

The final word

The kitchen industry is set to be busy over the coming year, however ongoing changes with Covid-19 developments may affect consumer confidence and potentially buying habits however this is yet to be seen.

Continued developments in online operations and improvements to the skill shortage gap are expected to have positive effects in the UK Kitchens industry not just in 2021, but for years to come.

About Passmore Group

Established In 1965 and based in Yorkshire, Passmore Group is a family-owned business specialising in the full design, supply, and installation of high-quality kitchen, bedrooms, and bathrooms. With a history now spanning more than half a century, the business has become the region’s most trusted and experienced full-service home improvement company.